We’ve been working with partners in Serbia for some time now, but haven’t had a chance to release a large scale app for that market like we have in Croatia and Slovenia. This has just changed.

When people ask me what kind of projects do I personally like to do, the answer is simple – I like projects that are going to be used by lots of people, preferably on a daily basis. With that criteria in mind, mobile banking certainly makes the cut. Whether you like or not, taking care of your finances is a necessity, and we like to help people to do that in a simple and enjoyable way.

Mobile banking

Mobile banking saves you time and gives you the ability to manage your finances anytime and anywhere . Gone are the days that you had to visit your bank branch. Better yet, gone are the days that you had to pick yourself off the couch and walk to the computer! Using mobile banking you can transfer extravagant amounts of money or just pay your bills while waiting at the doctors office.

When I talk to banks I always say – ”It’s not a matter of ‘will you have a mobile banking product’?”, it’s just a matter of ”When you’ll have to have it”.

Vote for simplicity

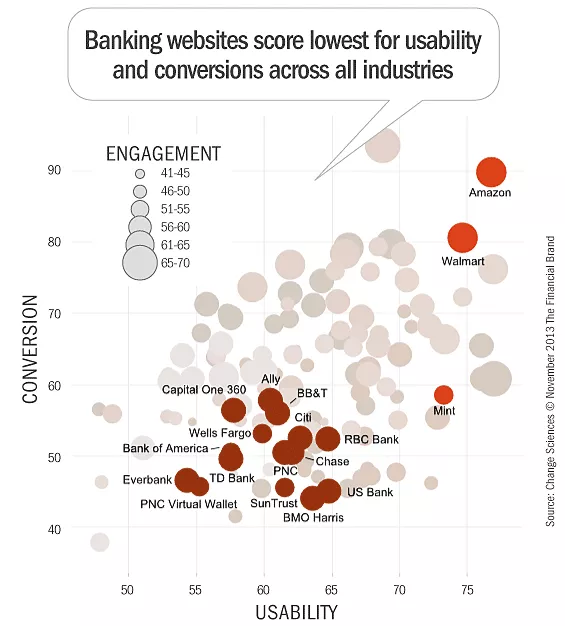

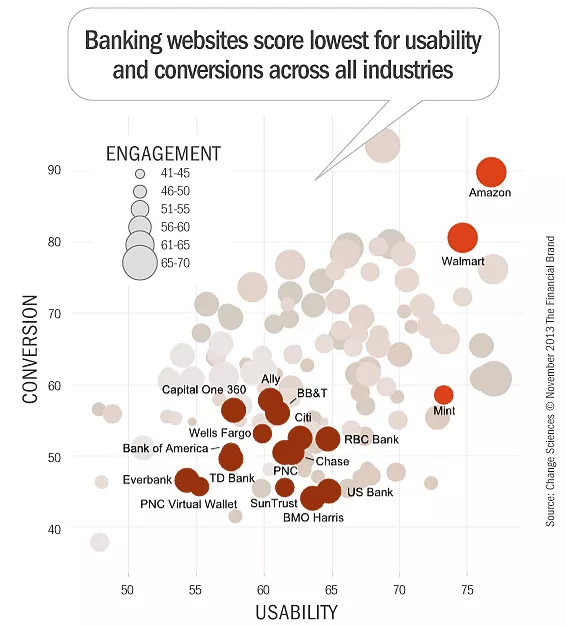

The reason we went into building mobile banking products 3 years ago was that we wanted something that we’d enjoy using ourselves. To be frank, banks aren’t typically known for the simplicity and ease of use of their digital products.

In all fairness – there are reasons for that. Information technology in a financial institution is complicated. Think about your regular IT project then add layers of security, state and group-wide compliance and legacy software built on top of that. It’s an enormous system with moving parts all around, and making any sort of improvement requires a massive effort.

On the other hand, your customers, people that actually use this stuff, expect their mobile banking app to be as cool and simple to use as Facebook. Banks didn’t typically pay attention to design and user experience before, and now they’ll just have to, if they want to stay competitive.

We’ve proved we can do this, like when we built EasyMoney as a prototype of the user experience we think works. So yeah, 3 years ago, we felt we could bring a change and move this market in a positive direction, which I think we did.

ErsteBank Serbia

Adapting our mobile banking solution to work with the payment system in Serbia was no walk in the park either. We’re talking about an enormous native Android application that needs to adapt to all the problems I mentioned above, but then again, try to follow new development guidelines, releases of new mobile operating systems etc.

This first step was getting our solution out there, working and in the hands of customers. The next steps will be improving and developing the solution even further.

I’m happy to say we’ve released Erste mBanking Serbia, which is our first large-scale product in Serbia.

Photopay

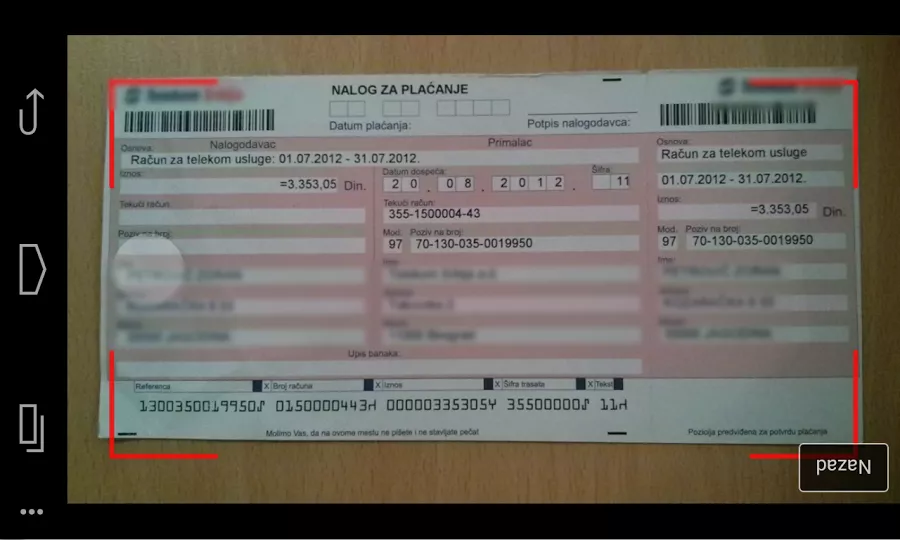

Another big piece of the puzzle was Photopay, a technology for scanning bills with your phone so you don’t have to manually input anything.

Serbia is a much complex market in terms of payment slips than Croatia or Slovenia, so the guys at Photopay had to develop some really smart systems to make the whole thing work.

I talked with Damir Sabol of Photopay, and he said:

After the success in a couple of European countries, we’re proud that, despite of the non-standardized payment slip market, PhotoPay is available in Serbia! To get to an excellent user experience, the biggest challenge in adapting PhotoPay technology for Serbia were all the different formats, poorly printed bills and slips from different issuers. Using advanced preprocessing, advanced digital image processing, a server-side developed OCR with machine learning capabilities, we’ve managed to achieve a good balance between accuracy and speed.

This is how it actually looks in action:

Download

The app is out on Google Play, so you can freely download it. The iPhone app is currently in testing, and should be available on iTunes App Store shortly.