Future-proof digital banking: safe, scalable, and powerful

RAIFFEISENBANK HRVATSKA

Facilitating digital transformation by creating a powerful mobile banking solution.

SERVICES

STRATEGY

UX DESIGN

UI DESIGN

IOS DEVELOPMENT

ANDROID DEVELOPMENT

ANALYTICS & GROWTH

QUALITY ASSURANCE

PROJECT INFO

Next-generation mobile banking, available today

Raiffeisen Austria d.d. has operated since 1994 as the first bank in Croatia founded with foreign capital and owned by a strong international financial group.

In 2019, the company decided to take the shuttle into the digital age and trusted us with digital transformation. Their previous mobile solution was based on outdated design principles that weren’t adapted to client expectations. Together, we eliminated the dependency on legacy systems by creating a modular architecture based on micro-services.

Customer-centric redesign

With a digital transformation strategy in place, RBA was eager to take on the challenge and rethink mobile banking. We made the product future-proof by forming a scalable architecture that allows the client to swiftly introduce features and improvements.

Gaining clarity about user needs and expectations was our priority. Each iteration and feature flow was tested and validated with the bank’s customers.

Agile banking for faster results

Corporate structure, strict regulations, and heavy administration are all expected in the industry as traditional as banking. Still, RBA was open to adopting an Agile approach. The client’s industry and customer knowledge combined with our expertise in building digital products resulted in a highly efficient, collaborative environment. Sharply focused on results, the project team worked according to Scrum principles and in biweekly sprints.

We heavily relied on Infinum’s expertise in building and integrating digital products into robust enterprise systems.

MATKO PEJČIĆ SCRUM MASTER, RAIFFEISENBANK HRVATSKA

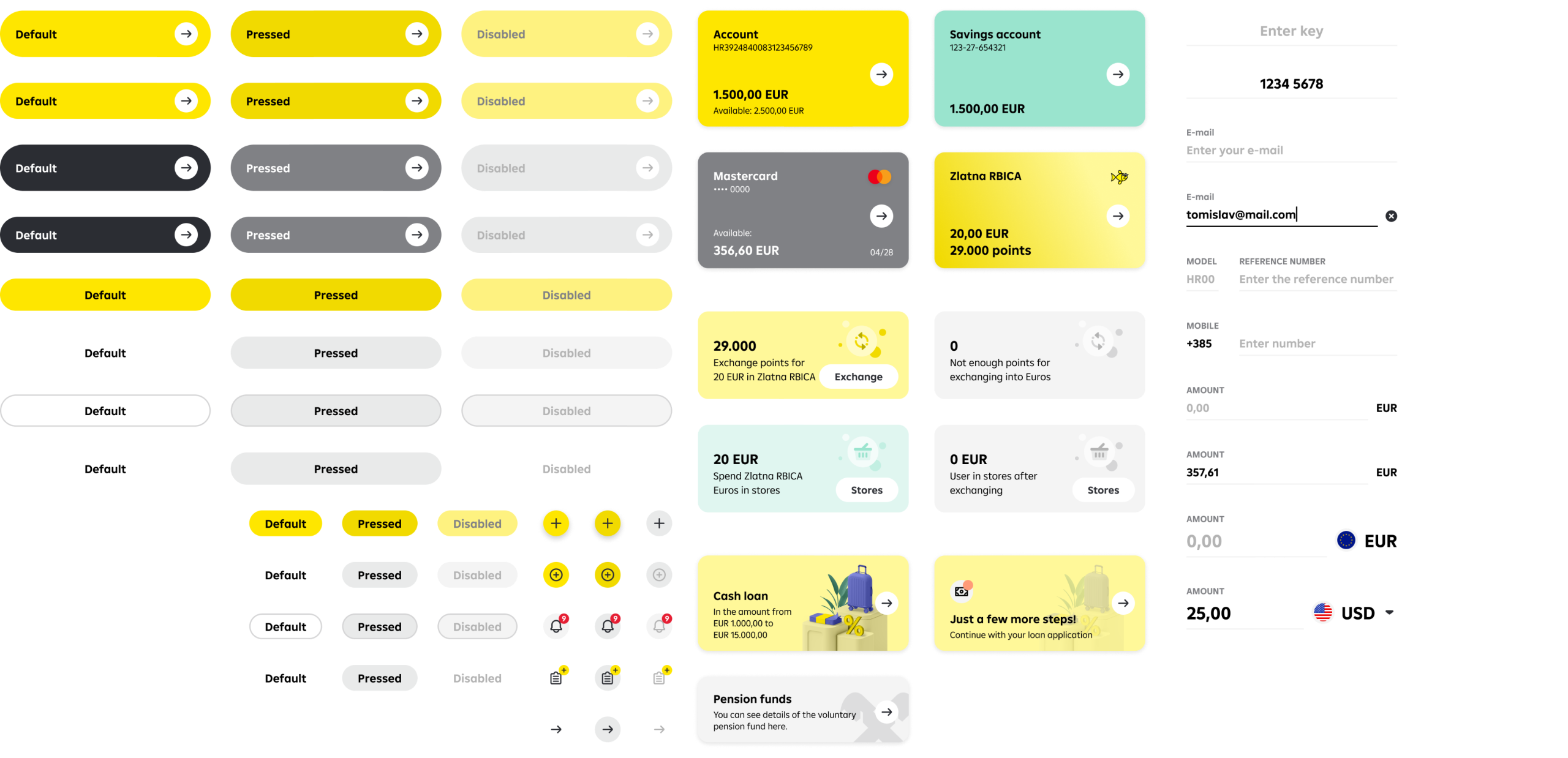

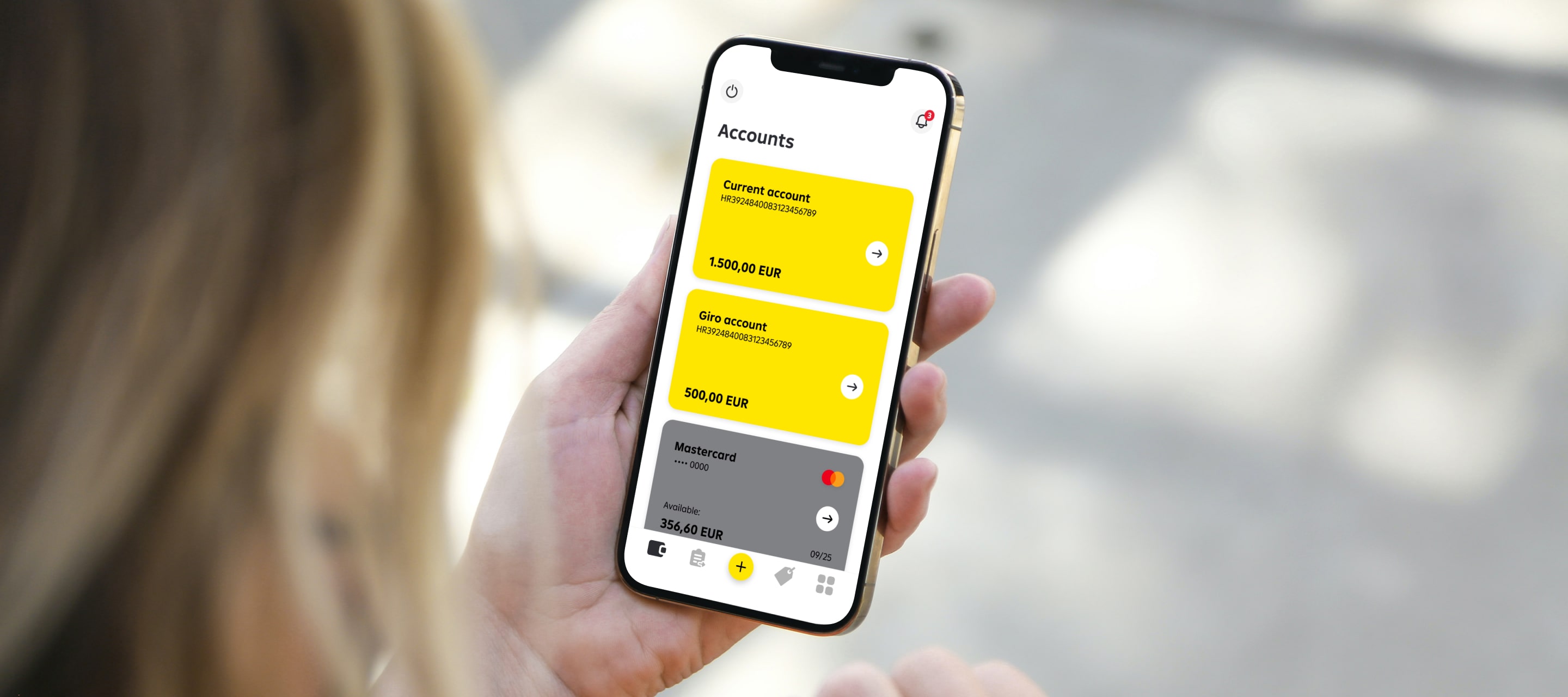

An entirely new design system is based on simple, cohesive and on-brand components. These building blocks enable RBA to easily introduce new features, while providing a dynamic, highly personalized experience for the end-user.

Accessibility first

A series of interviews helped the project team gain valuable insights into what people need and expect from their mobile banking apps. The findings were later translated into the information architecture that’s intuitive and easy to use.

Bank anywhere

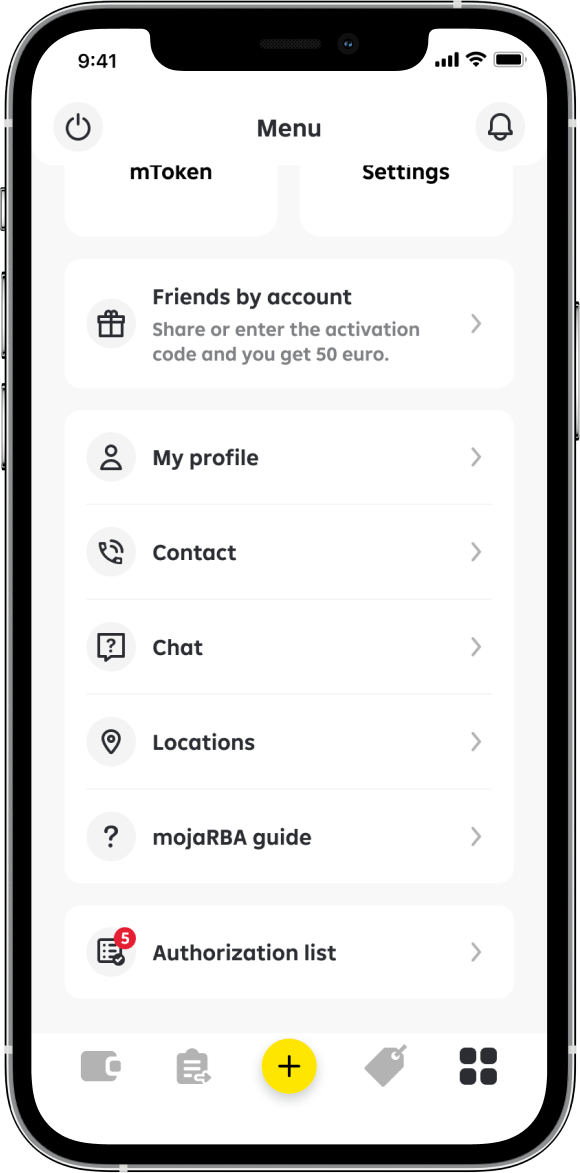

RBA’s ambition to become a true digital player is best reflected in prioritizing features that offer convenience through technology.

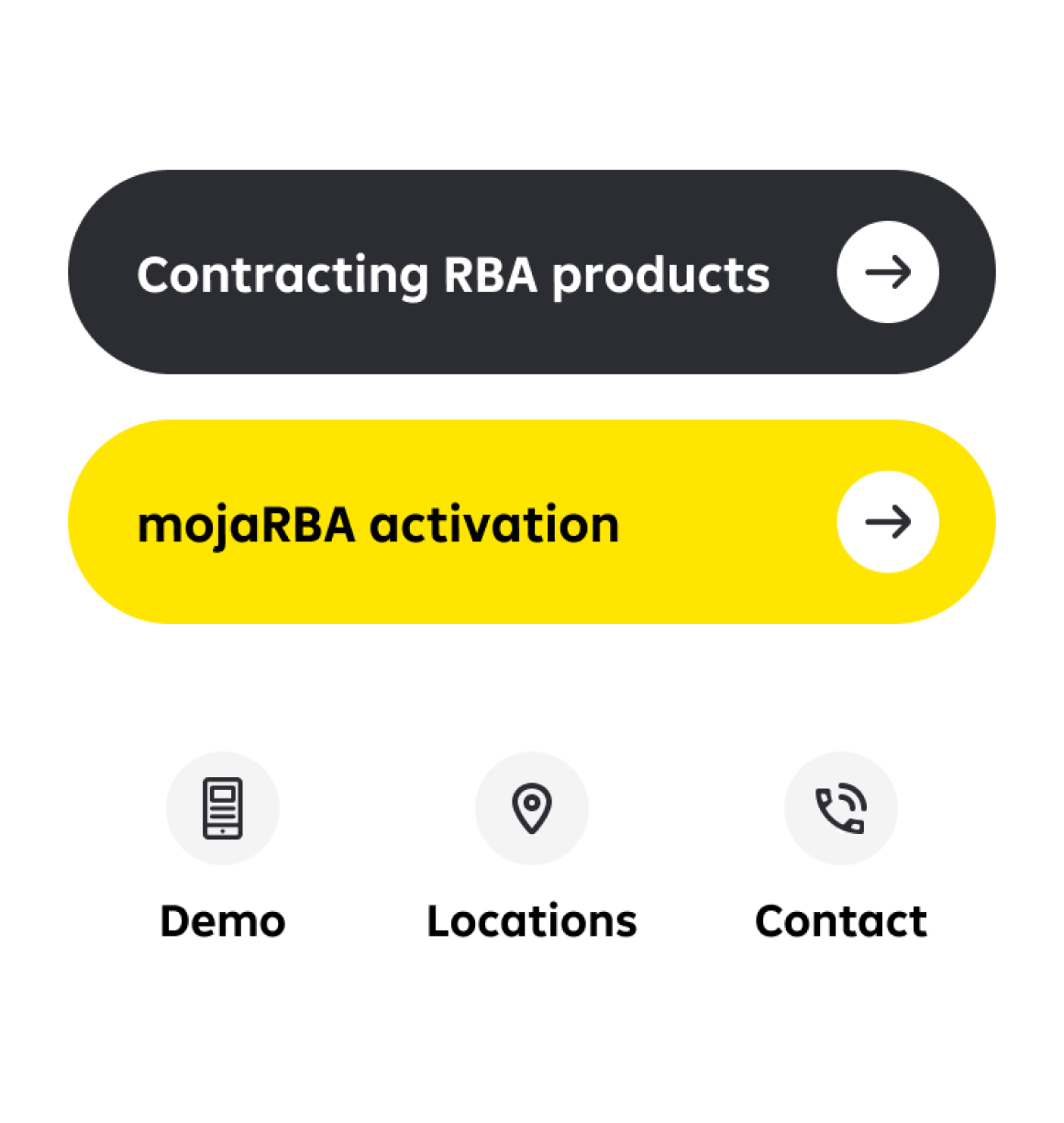

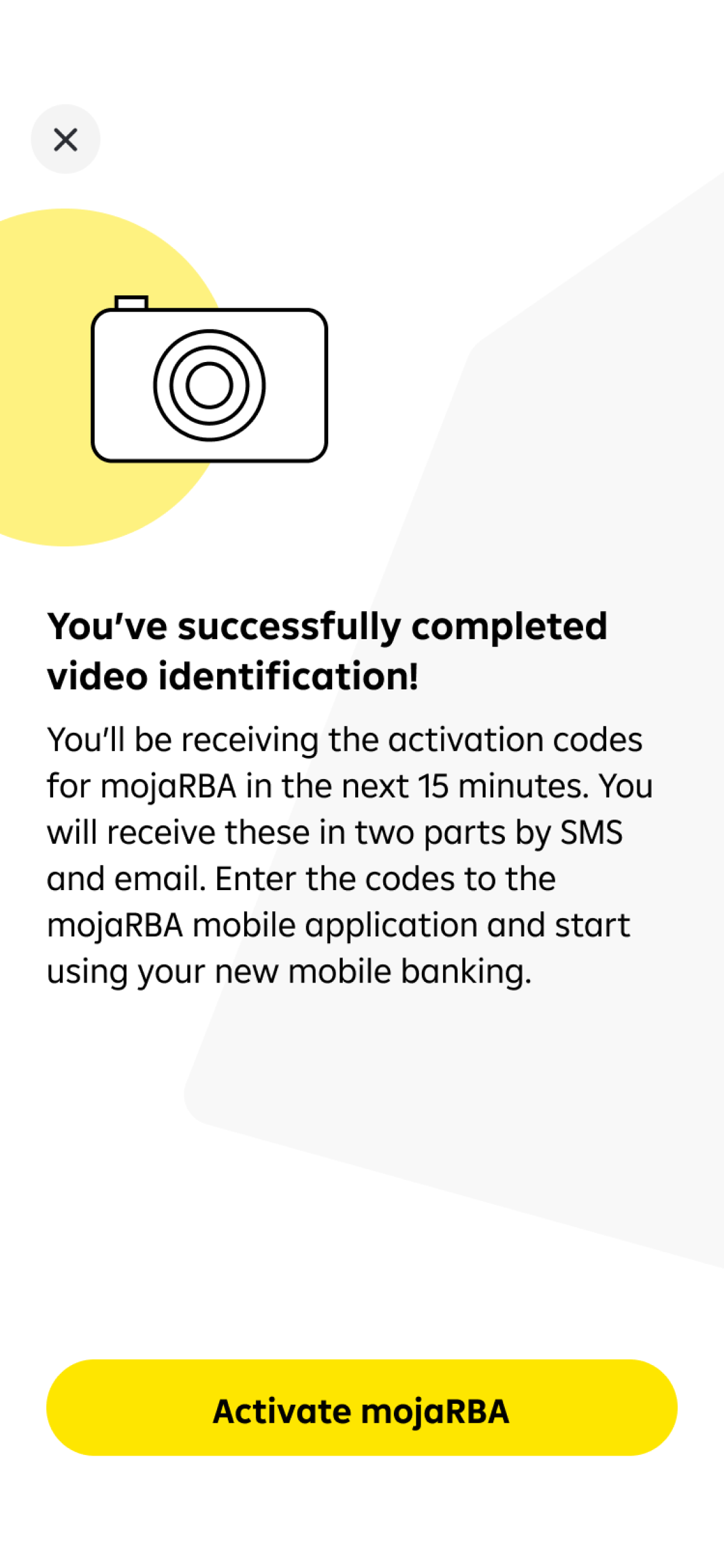

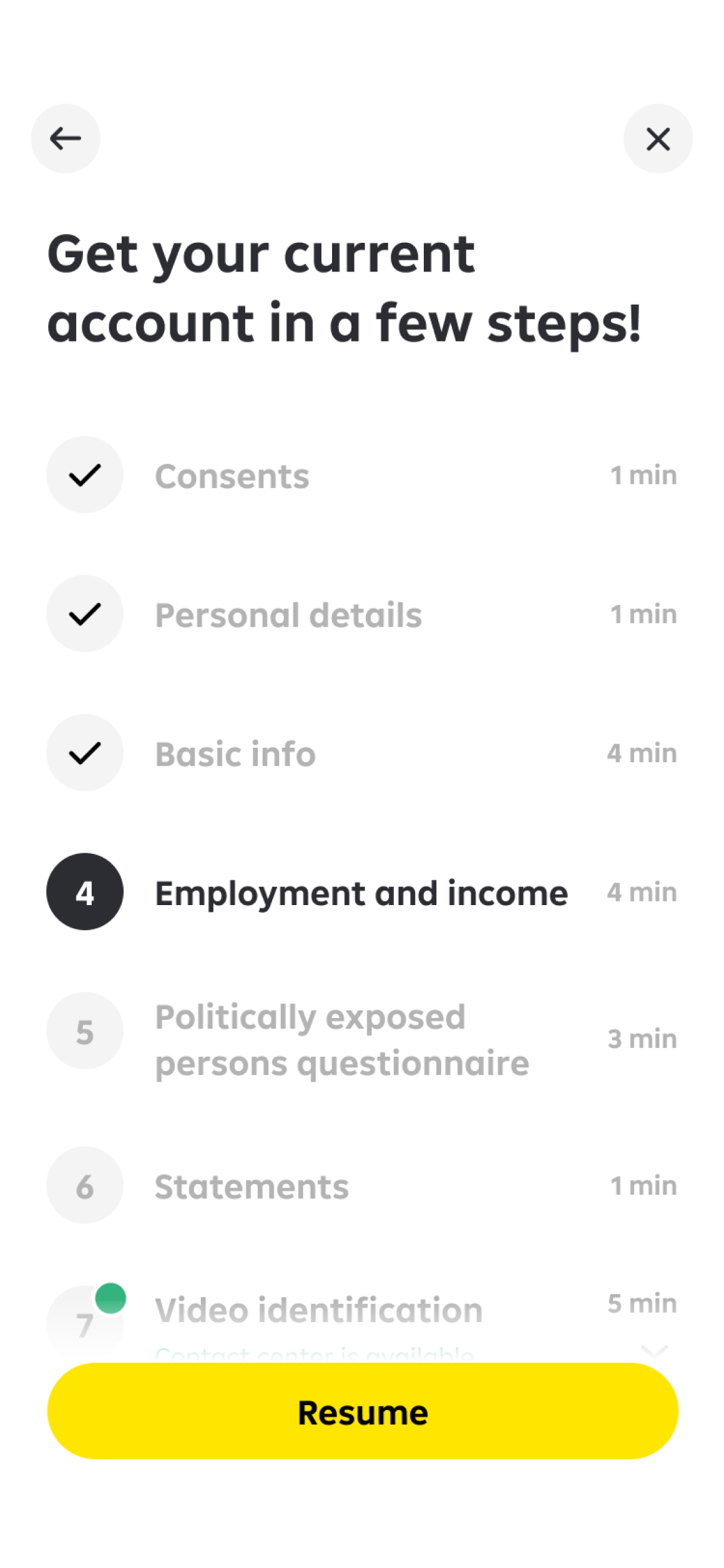

Open a bank account

Determined to close the gap between digital and physical service offers, the team at RBA leveraged the regulatory framework and adapted its internal processes. Opening a bank account with RBA is now available as a fully digital experience that’s both quick and safe.

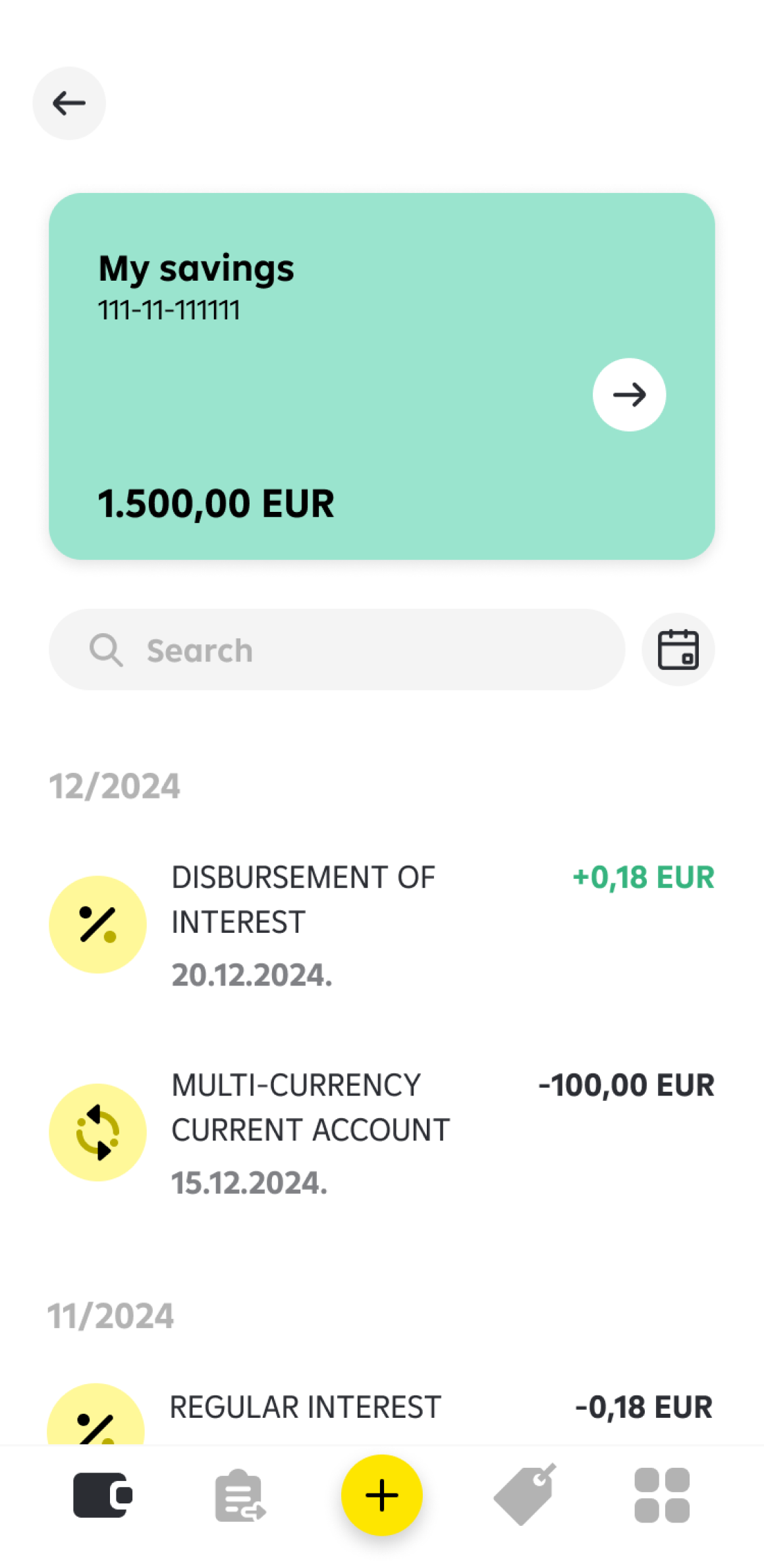

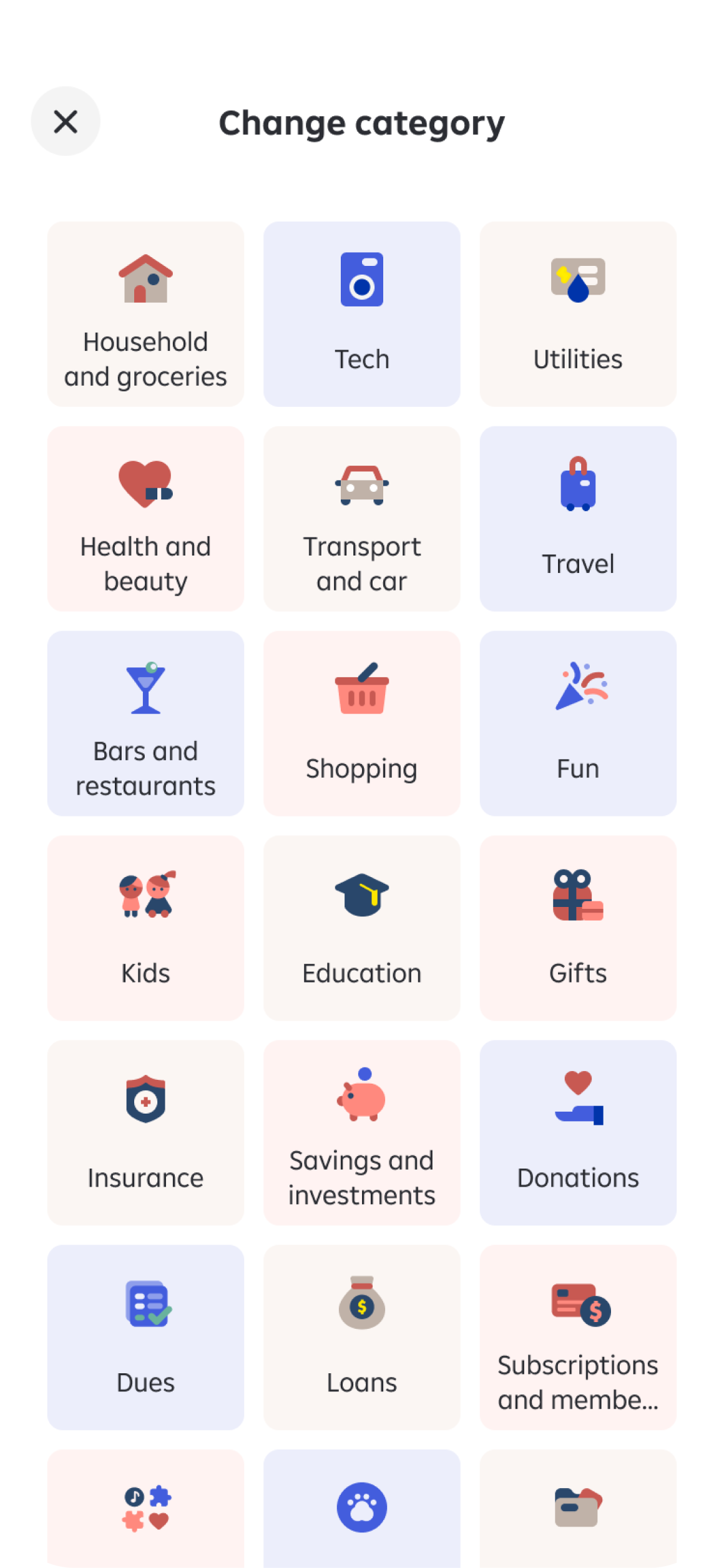

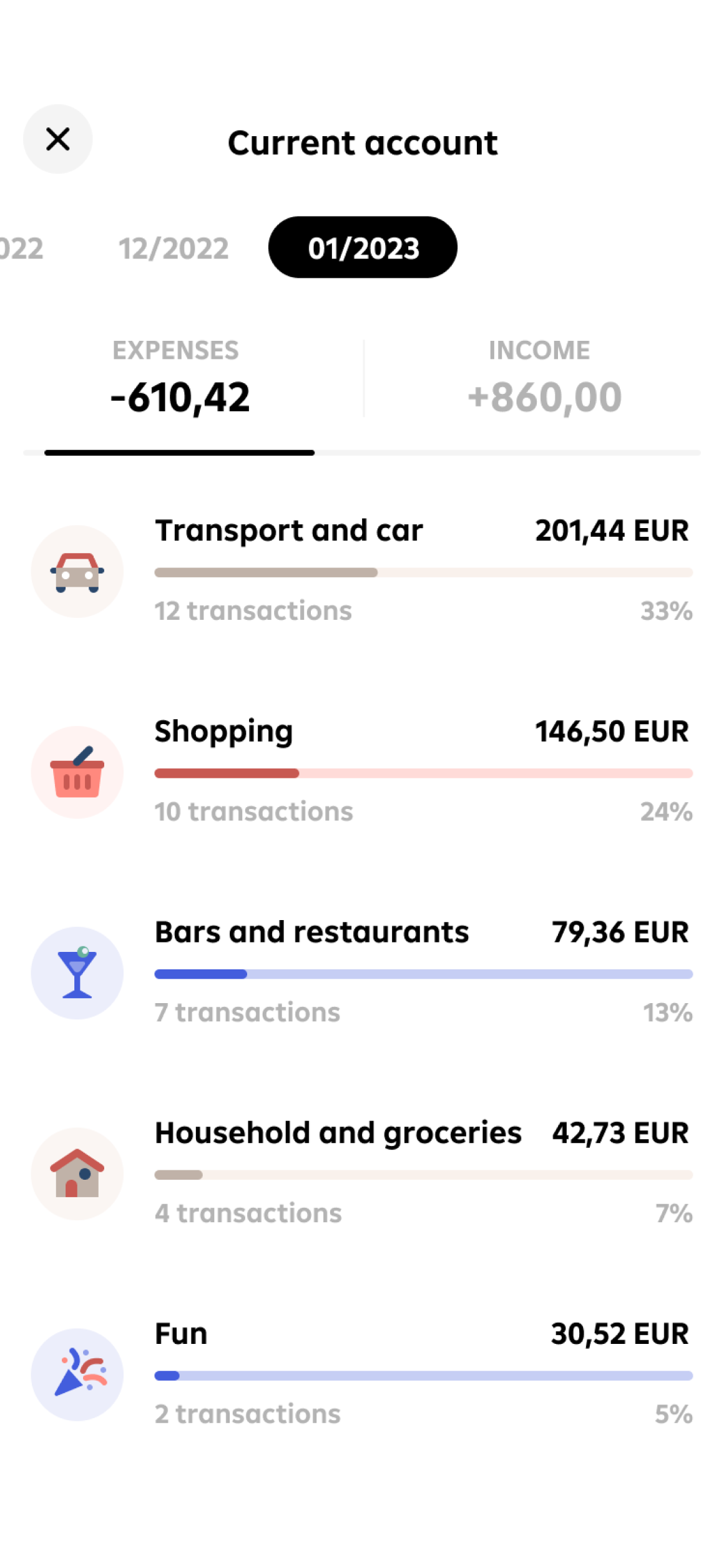

Track and manage expenses

Accounts, balances, transactions, cards, and loans are easily tracked within the app. Customers can manage and sort transactions into categories to gain actionable insights into their expenses.

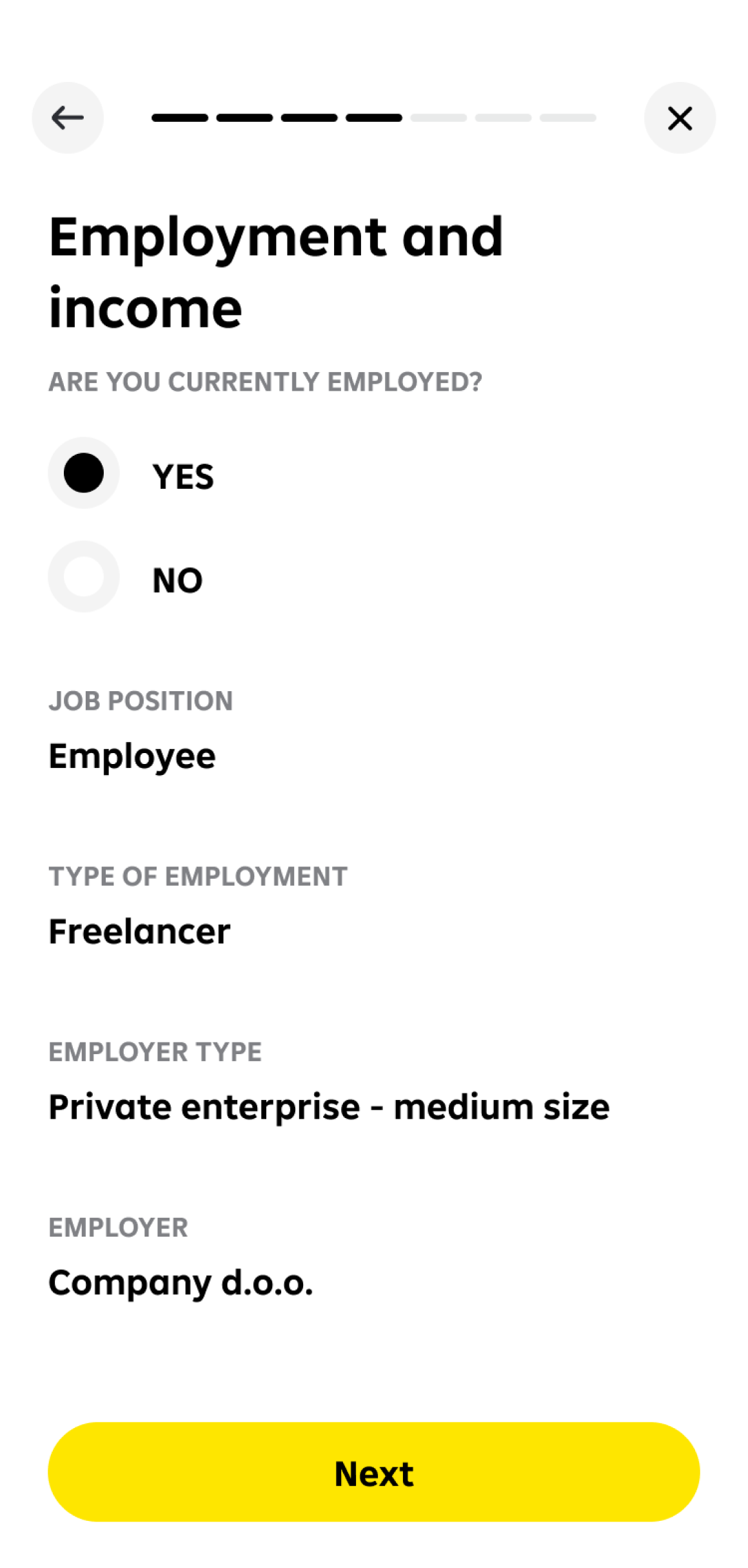

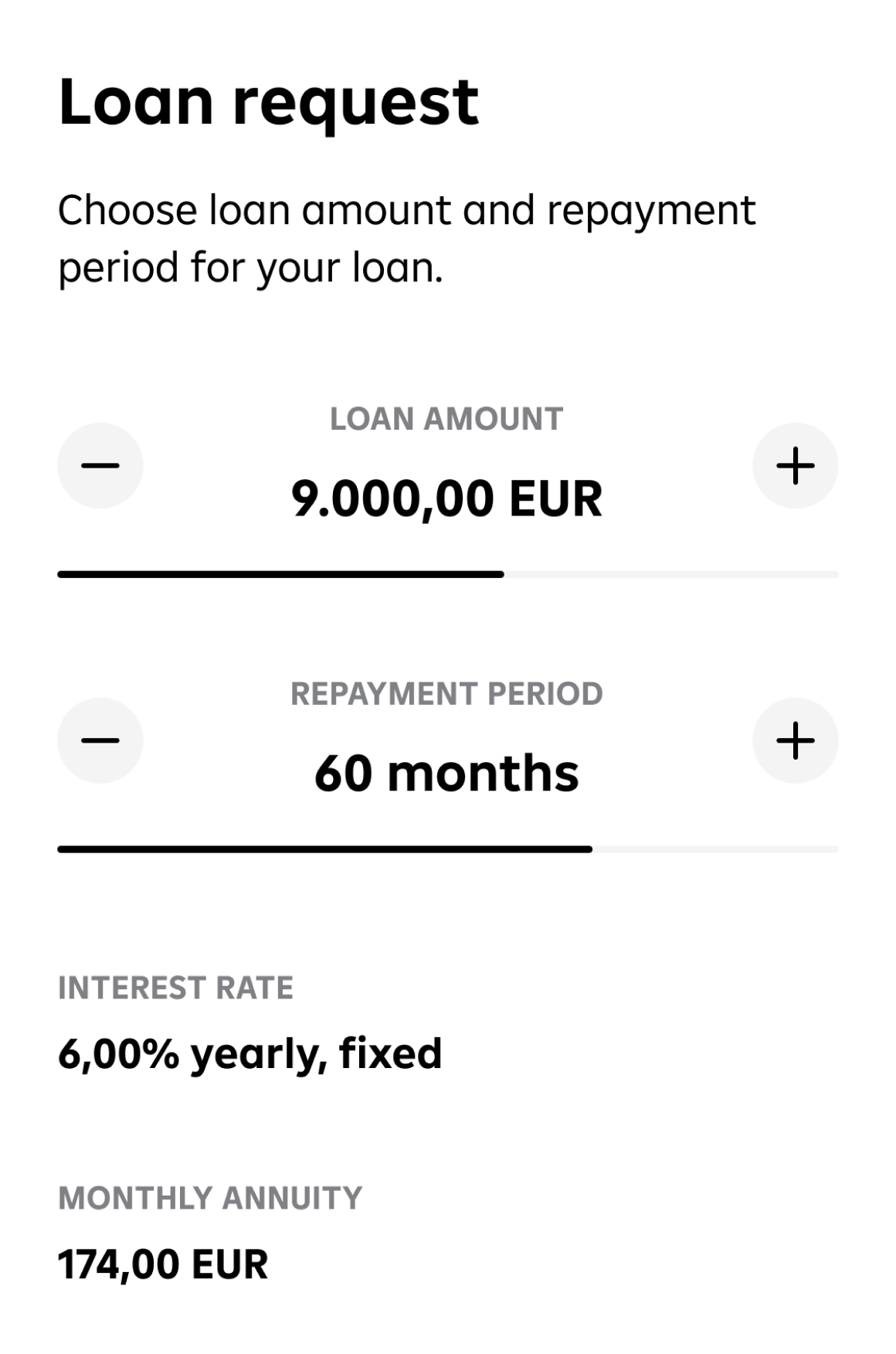

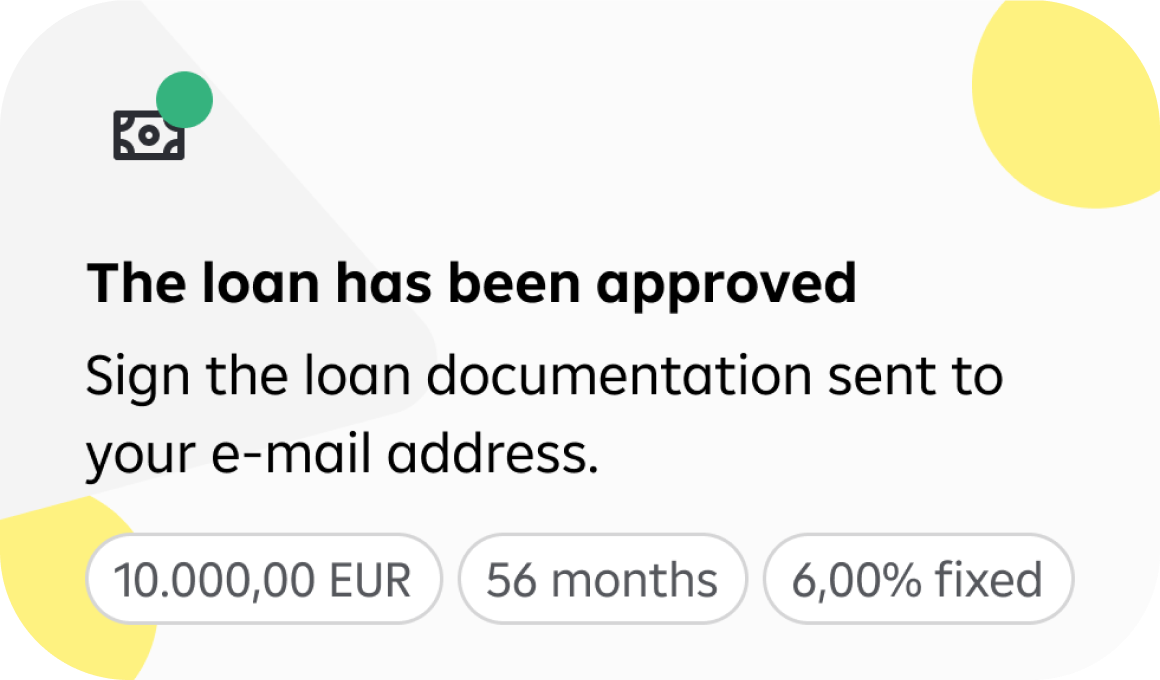

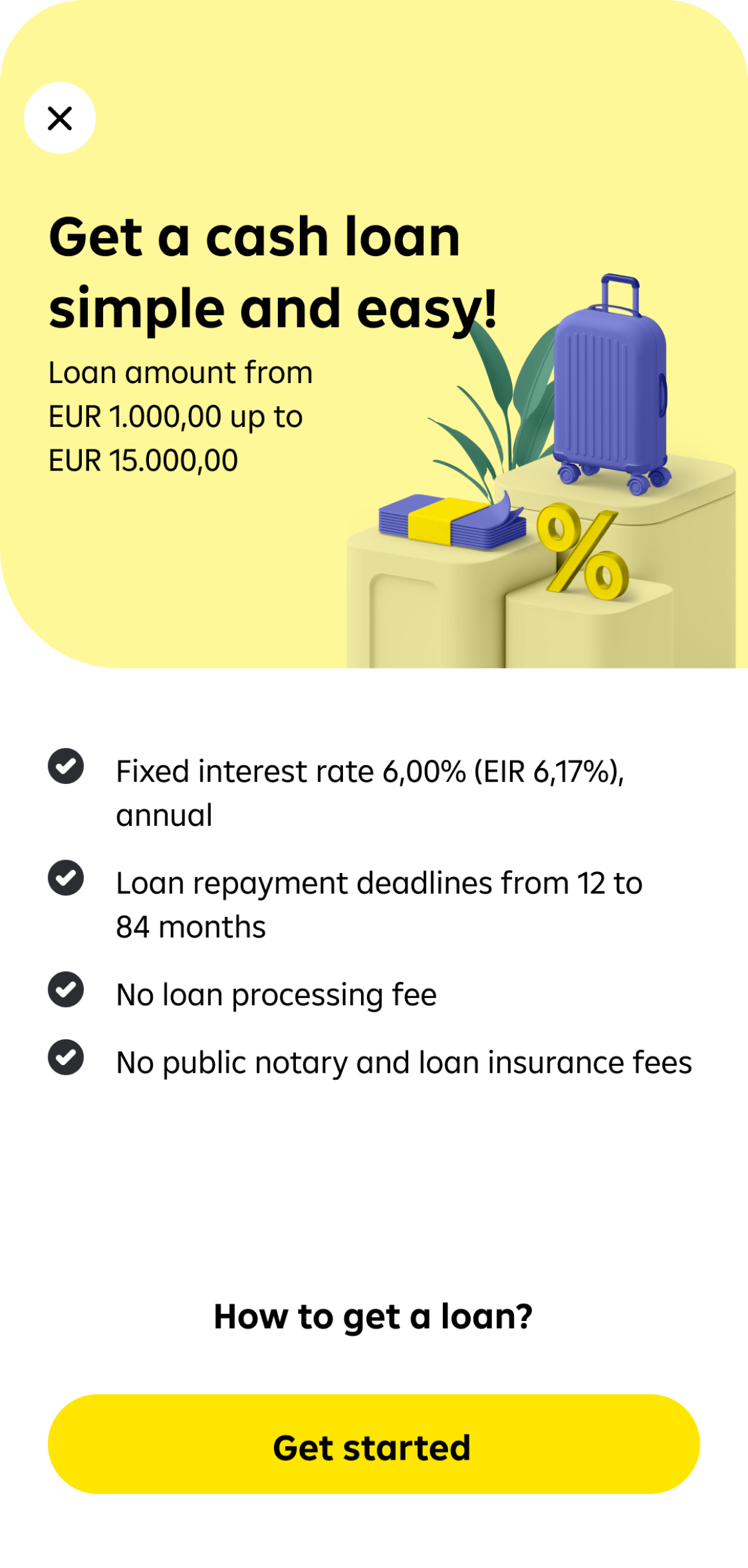

Get a personal loan

By moving cash loan applications online, we enable faster approvals compared to traditional banking. Choose the loan, confirm the details, and sign digitally—that’s it. The app walks the user through the process and provides real-time updates, ensuring an efficient and user-friendly experience.

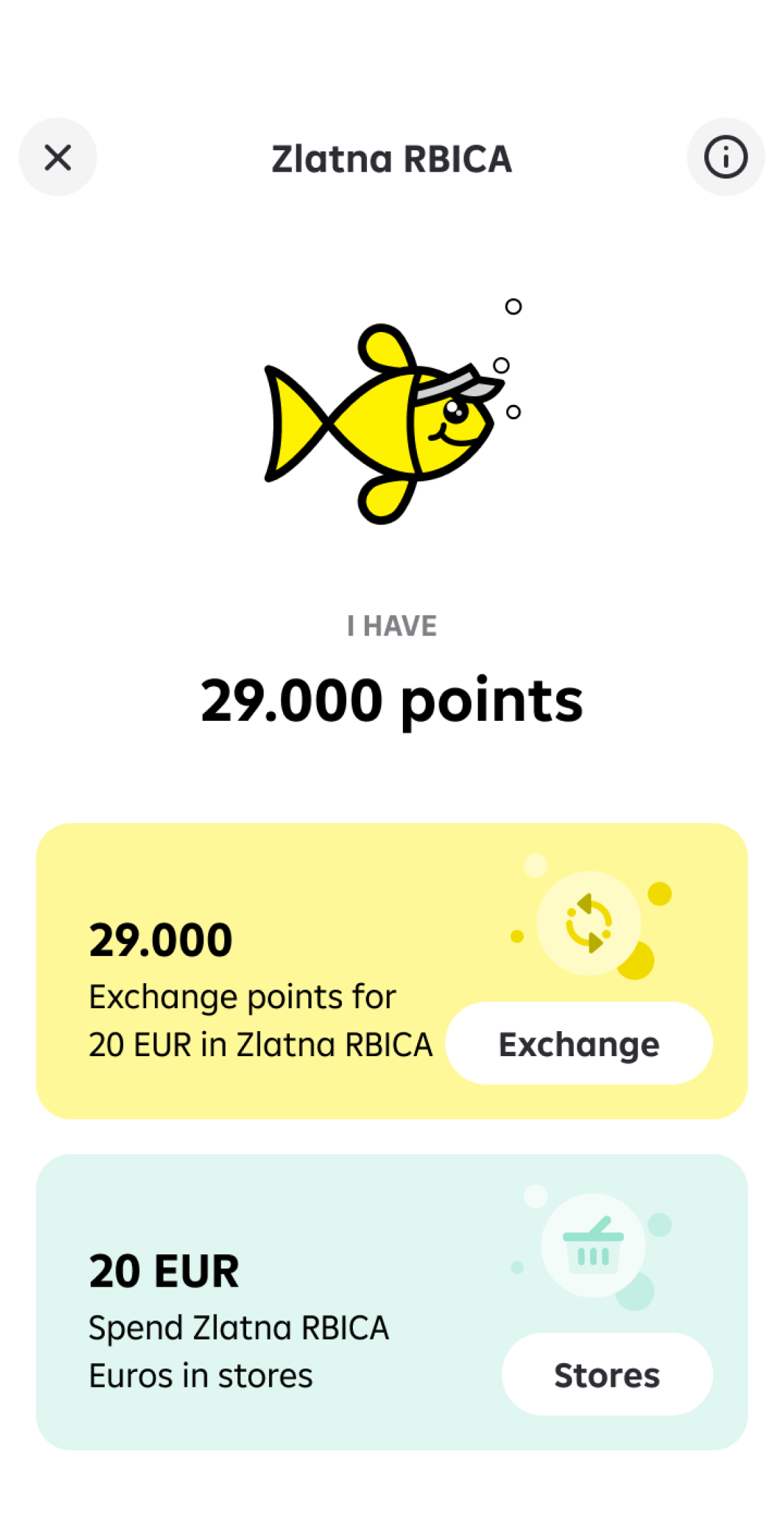

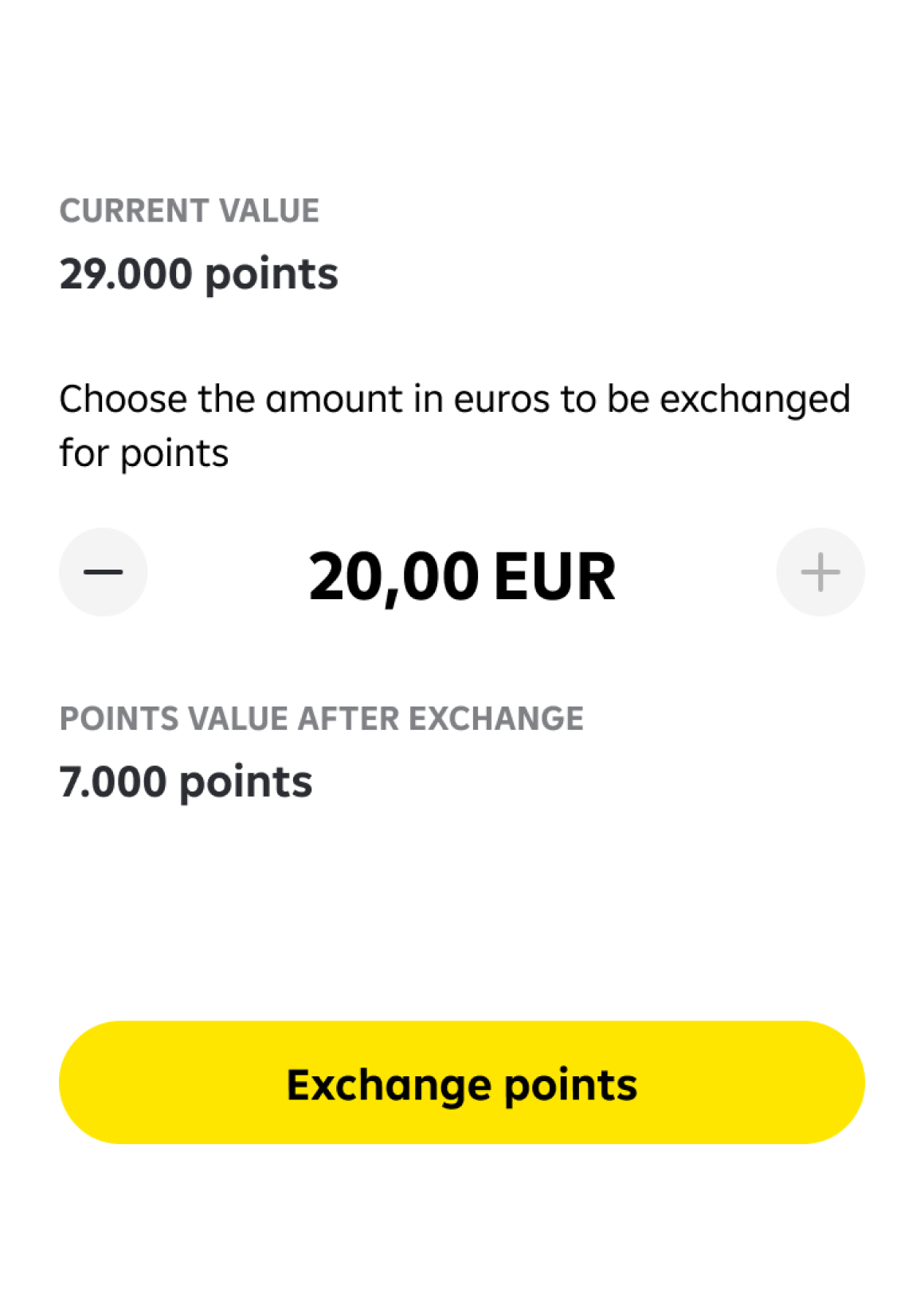

Earn rewards with every purchase

RBA runs a program that rewards customers for using its financial products. For each transaction a customer makes, points are added to their balance. These points can be exchanged for credit in partner stores when paying with RBA’s credit cards. We’ve made the rewards program interface uncluttered and simple to read.

Spiking user interest

With the latest features, user engagement has surged, showing a clear preference for mobile banking options.

Number of sessions

5.2M

Average user engagement

25.1 min

Loan requests through mobile banking

+8k

Loan approval time saved through automation

264 hrs

Infinum sets a high bar for expertise, transparency, and professionalism. The team helps us make informed decisions and proactively suggests tailored solutions to boost the user experience.

BRANIMIR PERETIN CHIEF DIGITAL PRODUCT MANAGER, RAIFFEISENBANK HRVATSKA

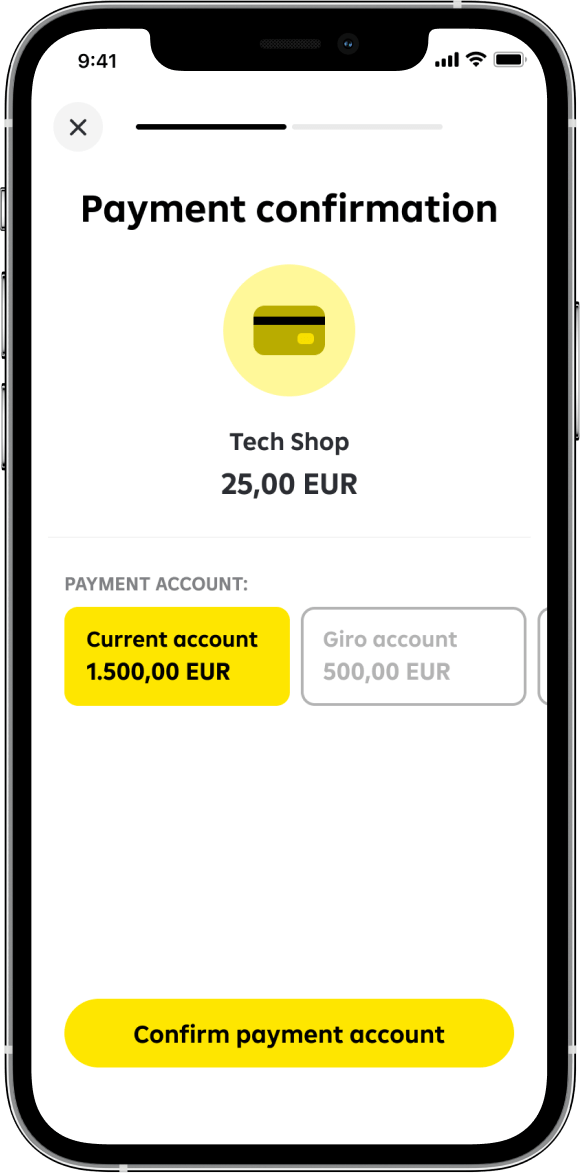

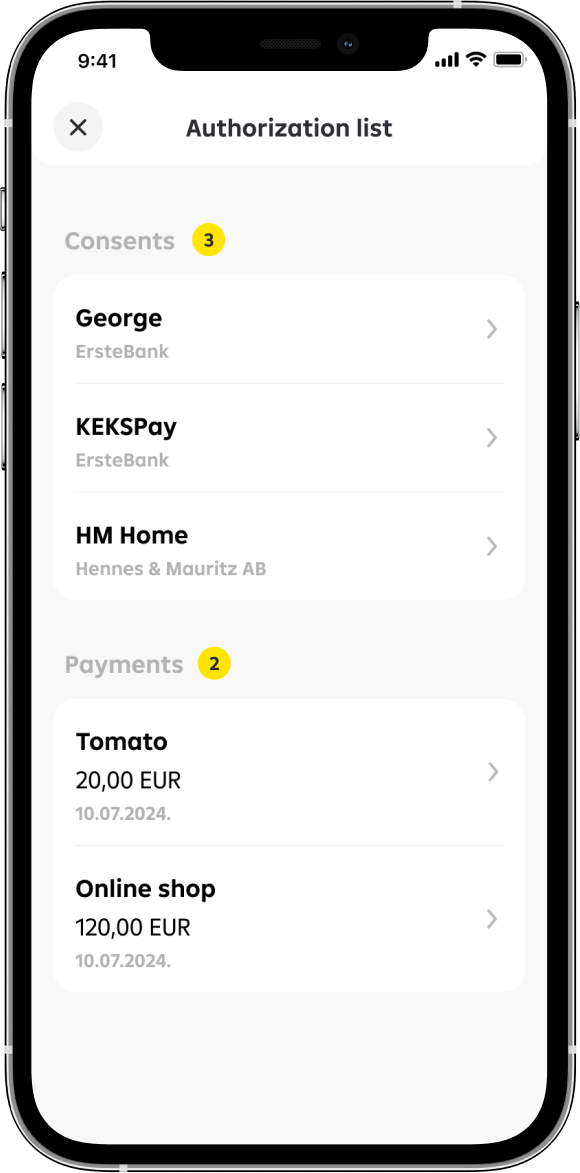

PSD2 compliance from the core

RBAs mobile solution is built to be fully compliant with the directive PSD2 that regulates payment services in the European Union. We worked with the client to make sure user financial data is protected, meaning all security requirements for electronic payments are fulfilled.

RBA’s mobile banking solution scores an excellent 4.7 in the App Store

Adoption rate

45%

Daily active users

100k

App Store rating

4.7

A LONG-TERM PARTNERSHIP

As RBA and Infinum continue their long-term partnership, new functionalities and improvements are being deployed on a regular basis.