Creating a next-generation jewelry insurance platform

BERKLEY ASSET PROTECTION

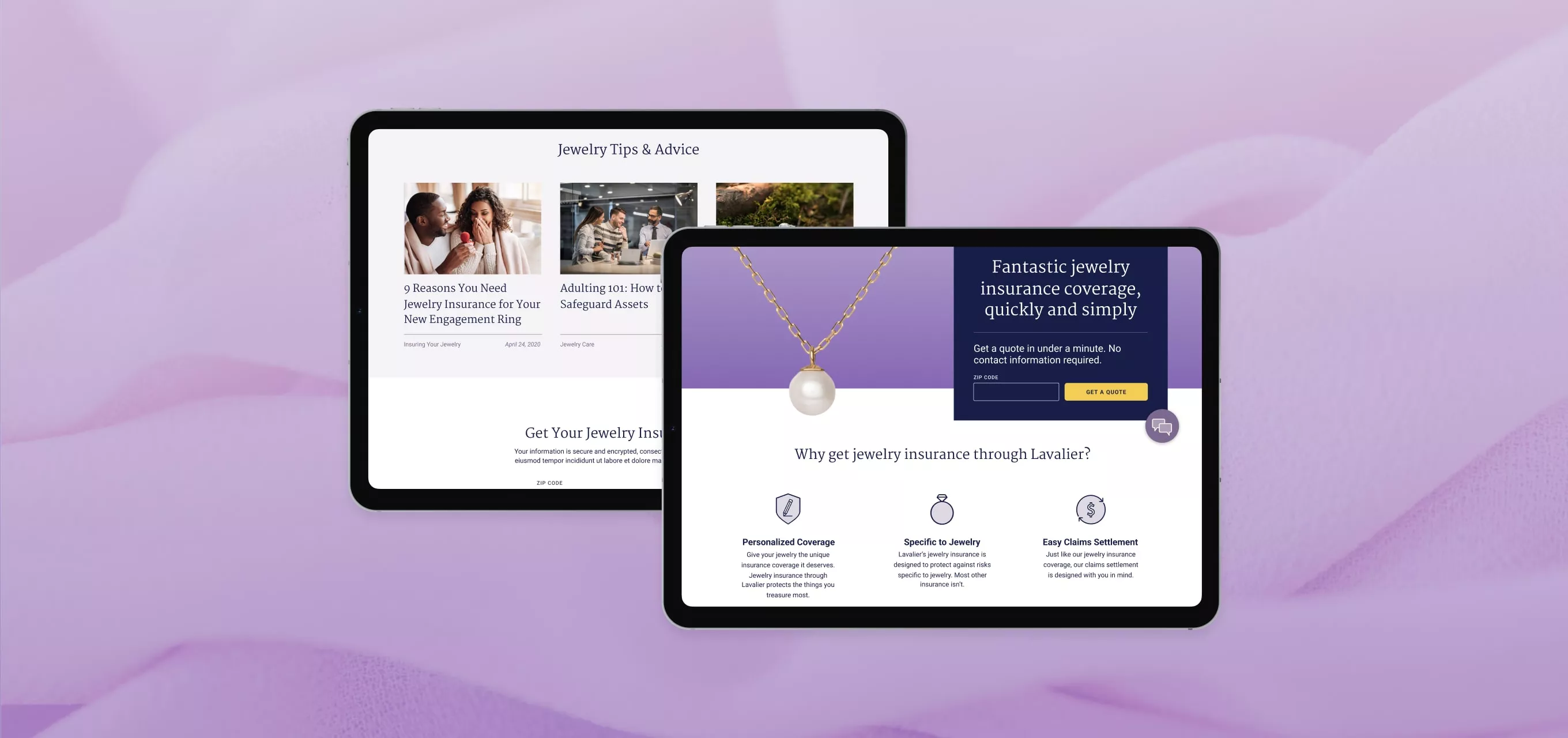

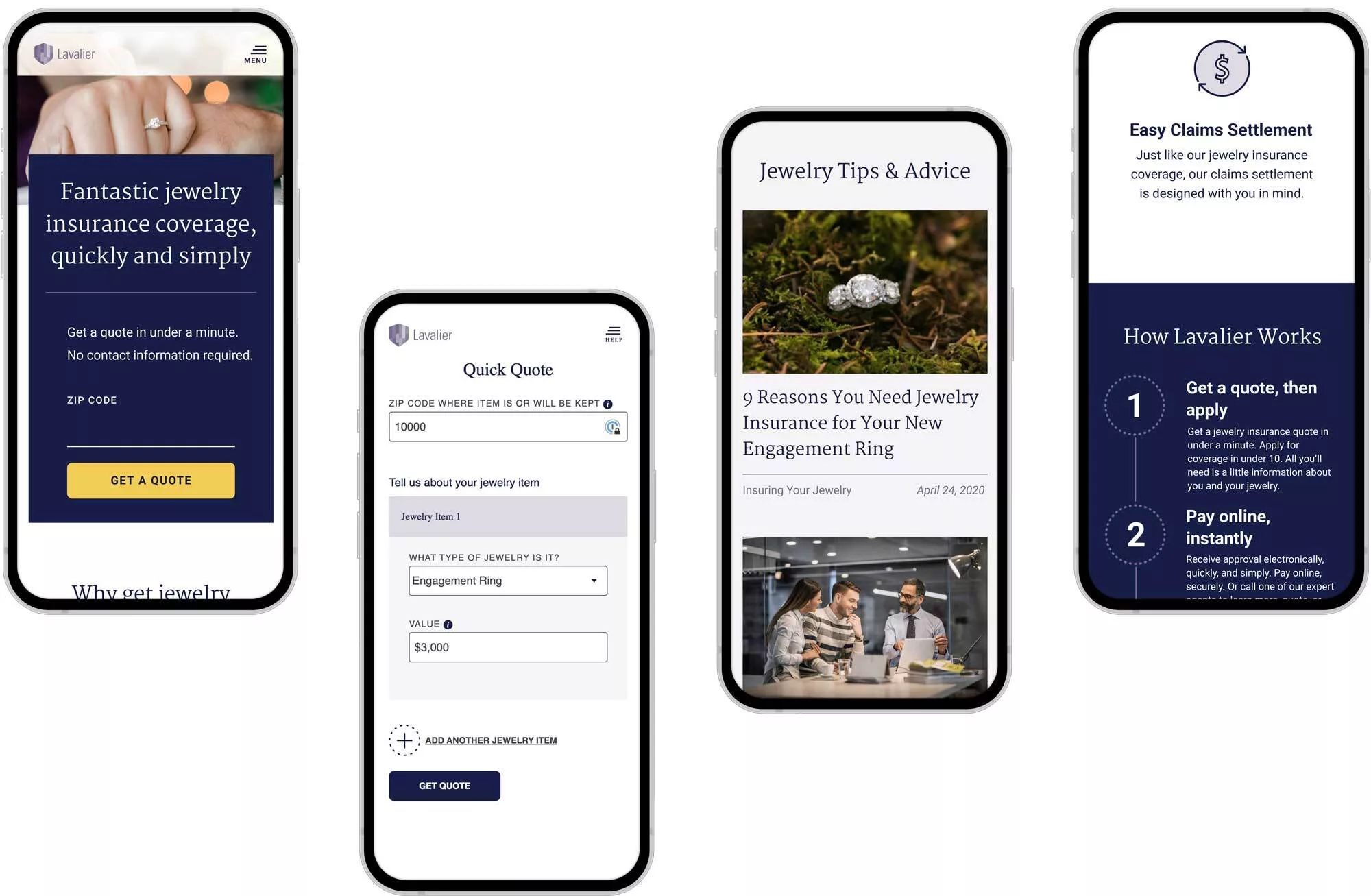

By automating multiple processes, we revamped Lavalier’s quote and policy system to create efficient self-service options for customers and underwriters.

SERVICES

USER TESTING

UX DESIGN

UI DESIGN

VISUAL DESIGN

SYSTEM ARCHITECTURE

BACKEND DEVELOPMENT

WEB DEVELOPMENT

PROJECT INFO

Helping a jewelry insurance platform truly shine

Berkeley Asset Protection, through its Lavalier business line, offers customers peace of mind through personal jewelry insurance policies.

Although some aspects of Lavalier’s customer-facing business were digital, most of the policy management and underwriting tasks still had to be performed manually and offline, and the user experience had room for improvement.

To continue growing and scaling its operations, Lavalier needed a solution to fully digitize its processes. Together, we reimagined their quote and policy system to create a modern platform, automating more than 20 time-intensive processes and introducing sleek self-service options for both customers and underwriters.

Taking Lavalier from manual to modern

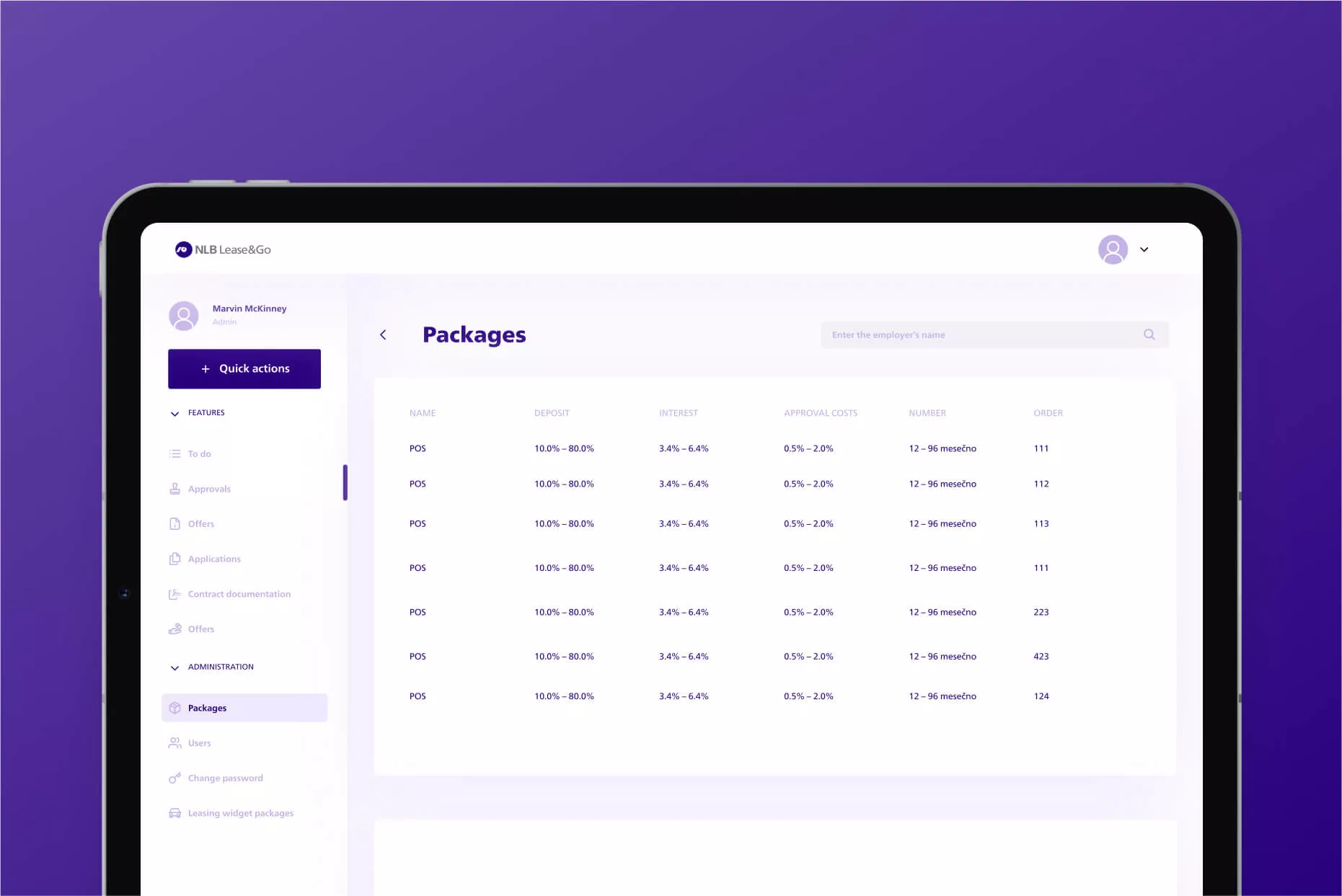

To meet Lavalier’s scalability, compliance, and performance targets, we architected a serverless AWS-based solution that streamlines their operations. The solution uses a custom API from our insurtech partner Socotra, and integrates with more than seven other external systems. This way, rating, communication, and verification functions are automated and nearly instantaneous.

The external integrations include:

- Frontend NuxtJS framework

- Stripe for payment processing

- Salesforce service and marketing cloud for various marketing and customer service functions

- Truepic for photo authentication

- Custom integration with a partner’s e-commerce API to facilitate expedited applications

- Socotra Policy Management System as the source of truth for policyholder and policy data

- Custom SSO integration with the client’s proprietary identity management system

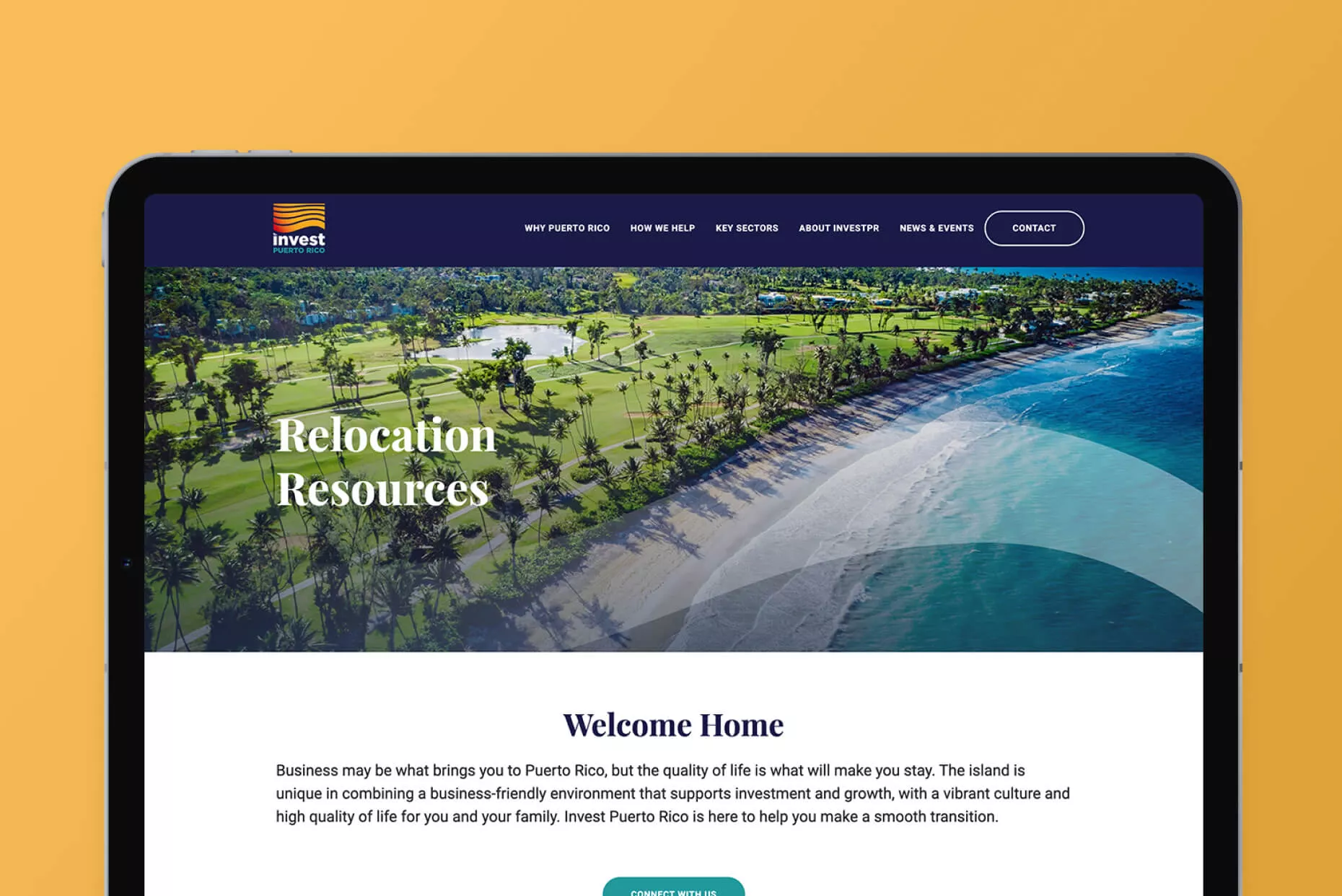

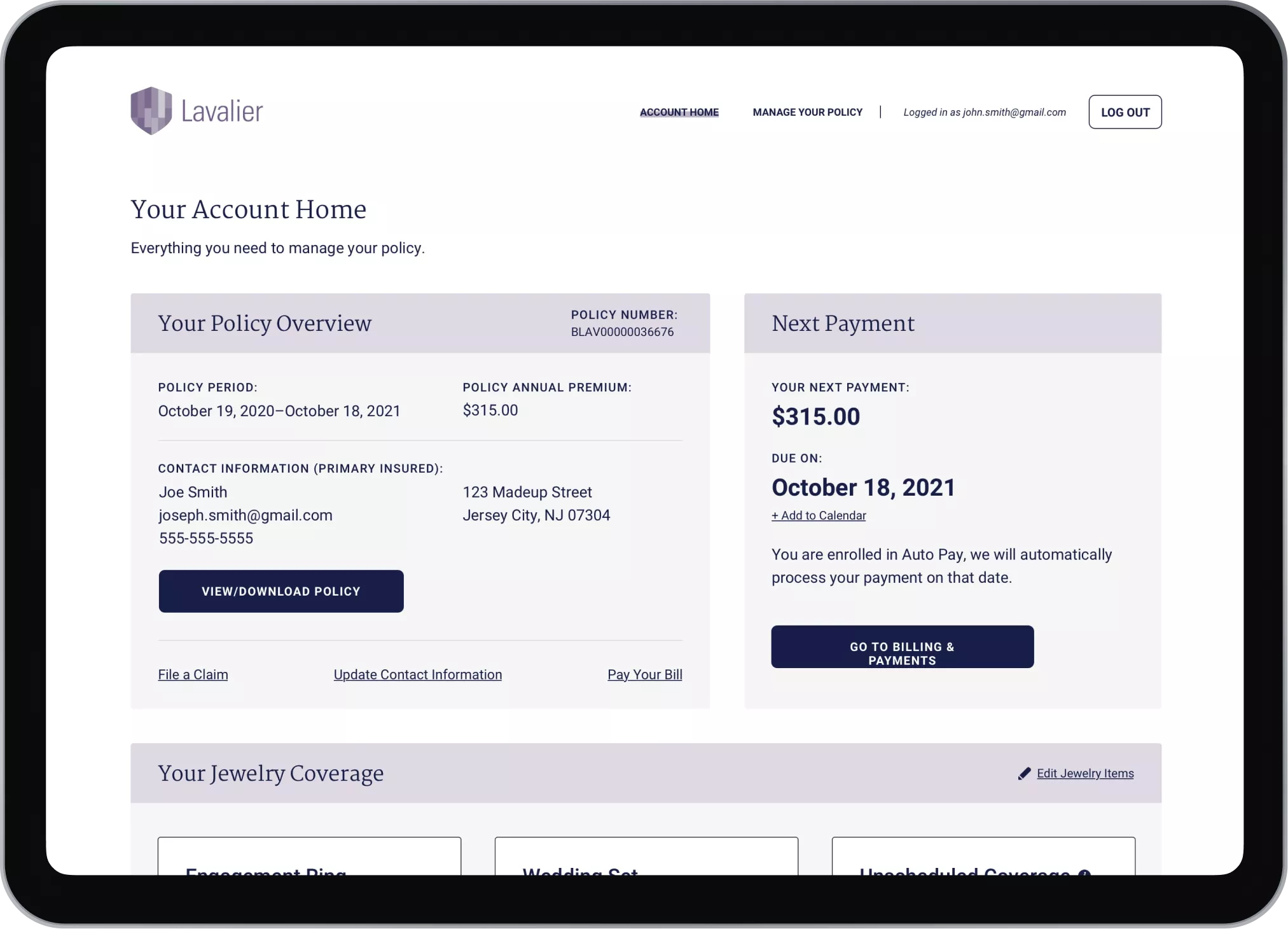

The platform thus provided self-service options for customer policy management, underwriter policy and exposure approvals, and affiliate performance tracking and management.

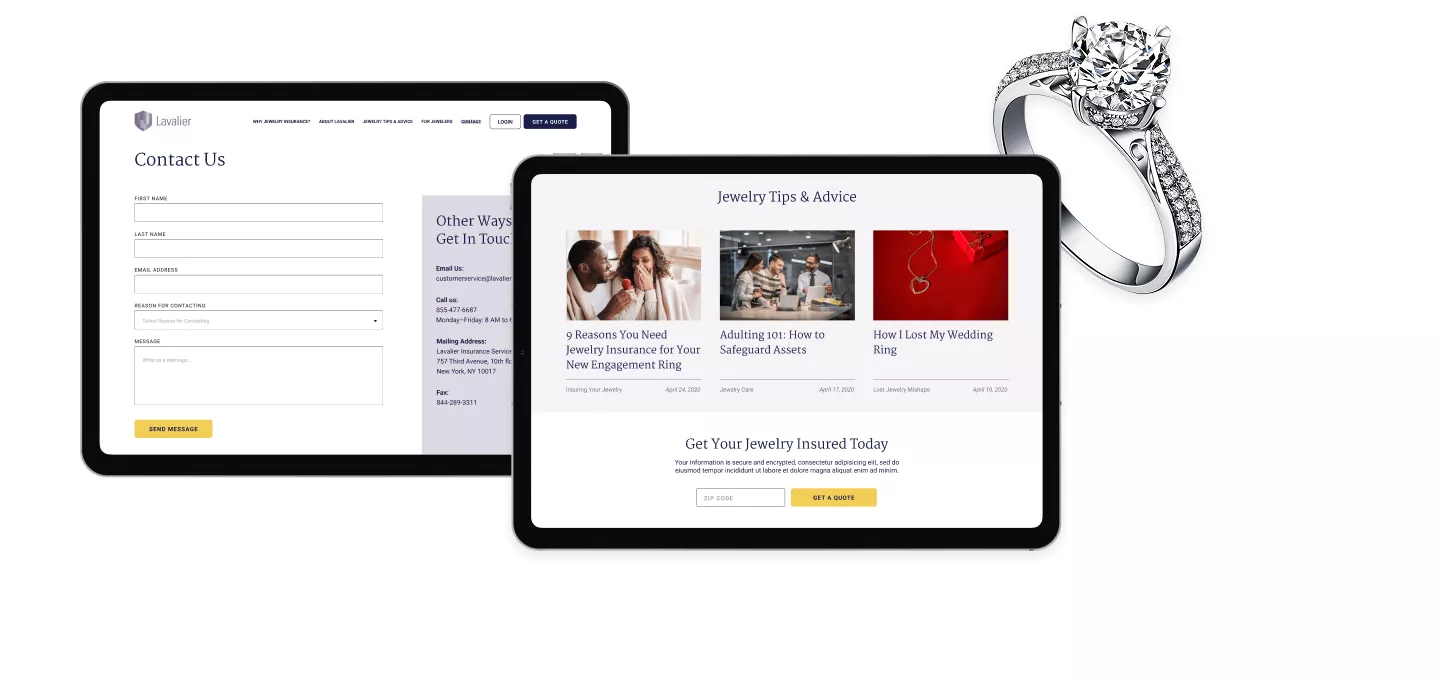

Having optimized the system’s backend, we focused on the user experience. Through usability testing, we identified pain points and made continuous improvements to the system’s interfaces, ensuring an intuitive experience for every type of user – customers, underwriters, affiliates, and other stakeholders.

Thanks to these interventions, Lavalier got a platform where policy information is easily accessible, quotes are instantaneous, and processes once bound by paperwork are now completed with just a few clicks.

A makeover that opened new doors

The impact of our collaboration went beyond improving the platform. Shortly after the new system went live, Lavalier announced two major strategic partnerships.

- Signet, the world’s largest diamond retailer, selected Lavalier as the exclusive insurance provider for purchases from Jared®, KAY Jewelers®, and Zales®.

- Progressive Insurance partnered with Lavalier to offer jewelry protection directly to consumers, making quotes available in seconds with minimal input.

Reaping immediate benefits from its recent innovation, Lavalier has proven how technology can transform traditional industries and help drive growth in a competitive market.

This project was executed by our US team, formerly known as ETR. The company was acquired by Infinum in 2023.